RACONTEURPH

Stories worth sharing

GrabPay gets e-money license from Bangko Sentral

POSTED BY: Lionell Go Macahilig2018-10-22 04:36:00 PHT

Grab, the Philippines’s and Southeast Asia’s leading Online-to-Offline (O2O) platform, recently announced it will rapidly expand the GrabPay mobile wallet in the Philippines. The announcement comes as Grab receives the e-money license from Bangko Sentral ng Pilipinas. With the e-money license, Grab consumers in the near future, will not only be able to use GrabPay for rides and express delivery, but a number of additional payments services. The Philippines is the 5th country in Southeast Asia where the full suite of GrabPay mobile wallet services becomes available.

“The Philippines has one of the highest percentages of people in Southeast Asia who do not have a bank account and who transact in cash. We believe Grab, an everyday app available on 1 in 2 smartphones in the Philippines can make a difference where other e-wallets have not been able to so far. The convenience of Grab’s many services and the millions of customers already using the Grab app every day, make us confident about the GrabPay wallet’s prospects. With the support from Bangko Sentral ng Pilipinas, we can now help millions participate in the cashless, digital economy without the need for a bank account or to download additional apps,” said Ooi Huey Tyng, Managing Director of GrabPay Malaysia, Singapore and the Philippines.

According to statistics from Bangko Sentral ng Pilipinas, more than 98% of transactions in the Philippines still happen in cash, whereas 86% of people remain unbanked. Cash handling and services also cost millions of pesos a year to the banking industry.

Grab consumers will soon be able to benefit from a full-fledged, safe and convenient mobile wallet, without having to leave the convenience of the Grab app. Grab announced a number of new features besides its existing payments functions for ordering rides, express delivery and peer-to-peer credit transfer. Starting today, Grab users will be able to top-up their prepaid SIMs from the Grab app, and soon, order food, pay their bills and purchases from their favorite stores and restaurants. As with rides, new services may help customers earn points with GrabRewards, Southeast Asia’s largest loyalty programme, with offers from top brand partners such as SM Cinema, Cebu Pacific flights, McDonalds or Globe prepaid.

Major merchants, restaurant partners and small businesses will also be able to receive mobile payments with GrabPay’s QR technology. Grab believes its large customer base of millions of driver-partners and consumers across the Philippines, will help to incentivise the adoption of mobile payments among merchants.

Grab as the app offering essential everyday services in areas such as mobility, food and other services to more than 110 million consumers across Southeast Asia is best placed to make a difference. The GrabPay mobile wallet built into the Grab app offers a low-entry barrier to secure cashless payment options for both consumers and merchants.

Grab the Everyday Superapp experience

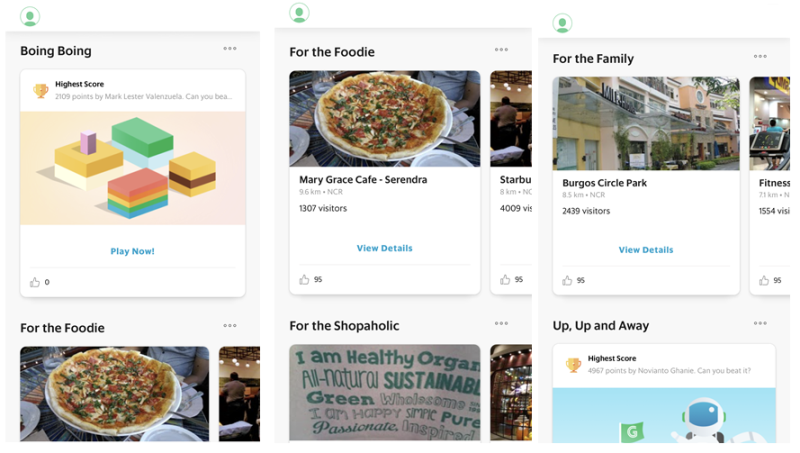

Filipino Grab users will soon be able to experience the new Grab Superapp. This will allow quick access to the GrabPay wallet, easy navigation to all Grab services and personalized news feed.

The new face of the app features a news feed that is localized, useful and informative, when you’re on the go. Featuring news, reviews and entertainment, Grab consumers can see nearby restaurants recommendations, play games, get exclusive deals from shops.

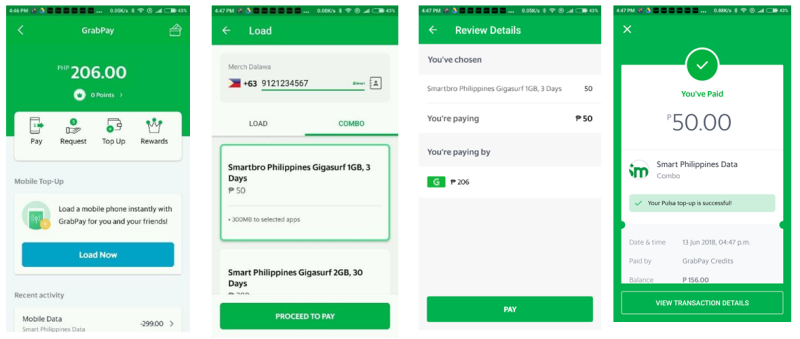

Top up prepaid load through GrabPay

The first feature to be launched by Grab under the e-money license will be the option to top-up prepaid load from the Grab app. Users in the Philippines who wish to top up their prepaid load, can tap the ‘Load Now’ bar below the GrabPay mobile wallet bar alongside other features including send, request, and top up wallet. After entering the phone number to be topped up, they can select their top up product. The request is sent to the telco service provider and receipt provided.

.JPG)