RACONTEURPH

Stories worth sharing

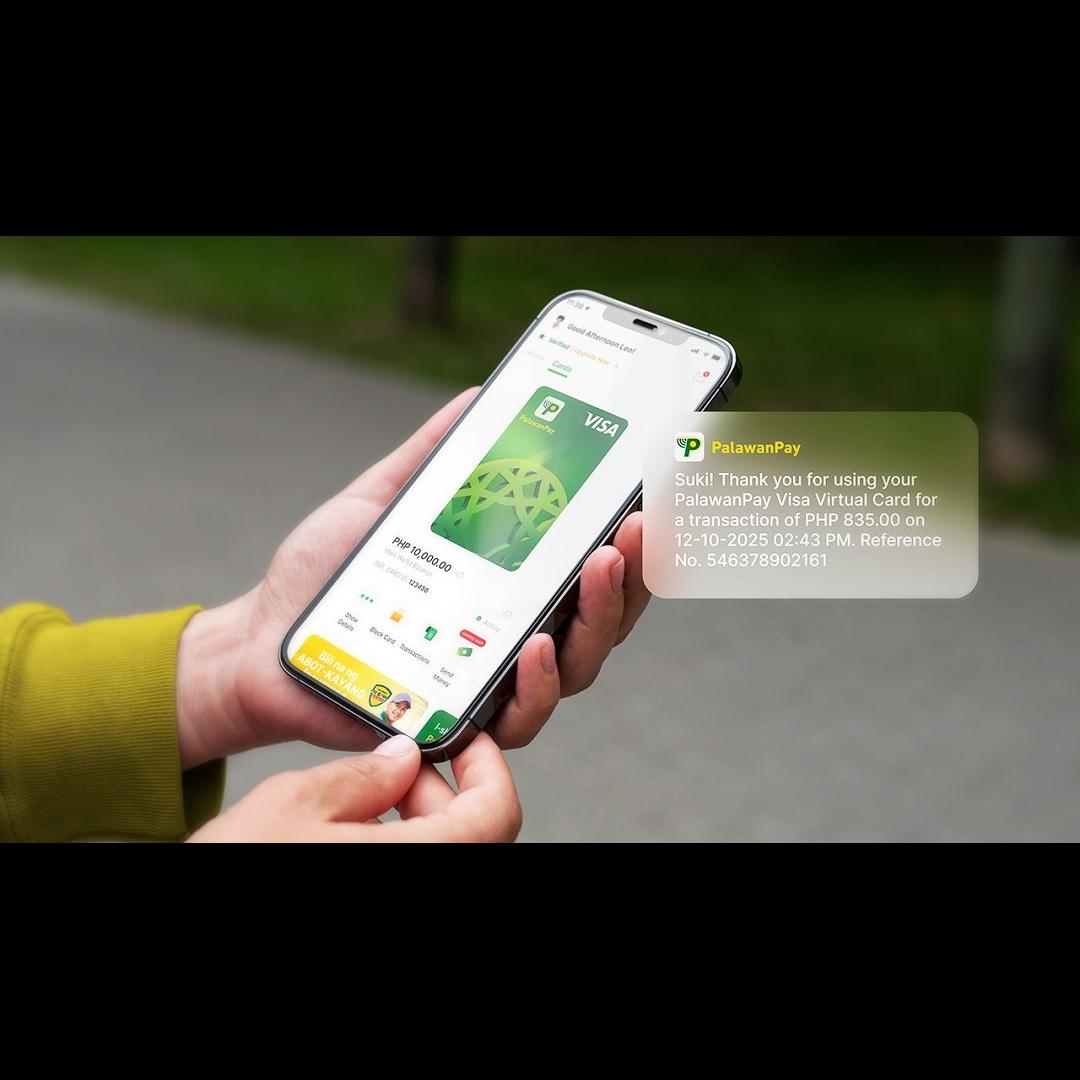

There’s A New Virtual Visa Card from PalawanPay, And Here’s What You Need to Know

POSTED BY: Lionell Go Macahilig2025-12-16 18:30:16 PHT

Staying true to the Palawan Group of Companies’ mission of advancing financial inclusion, PalawanPay — the company’s fast-growing e-wallet — unveils the PalawanPay Virtual Visa Card, a major leap in making simple, secure, and widely accepted digital payments accessible to every Filipino, including those without bank accounts or credit cards.

PalawanPay CEO Third Librea shared: “For many Filipinos, owning a Visa card has always felt out of reach — something reserved for those with bank accounts or credit lines. With the PalawanPay Virtual Visa Card, we’re changing that. We built this to be simple, practical, and truly pang-masa. Now every Filipino, every suki, can access global commerce with confidence — securely and affordably.”

Cashless, Cardless, Limitless — Designed for the Digital Filipino

With just a few taps inside the PalawanPay app, verified users can instantly activate their Virtual Visa Card and start transacting online.

From e-commerce shopping and recurring bills to travel bookings and streaming subscriptions, the PalawanPay Virtual Visa Card delivers a safer, more seamless way to pay — no long forms, no rigid requirements, no hassle. True to Palawan Group’s walang kuskos-balungos promise.

Palawan Group Chief Marketing Officer Bernard Kaibigan remarked: “PalawanPay’s Virtual Visa Card is more than a new feature. It is a step toward a more inclusive digital economy. Our goal is simple: to make digital finance truly para sa lahat (for everyone) — practical and within reach of every suki.”

Financial Inclusion, Levelled Up — Making the Digital Economy Accessible to Every Suki

The PalawanPay Virtual Visa Card empowers unbanked and underbanked Filipinos to participate confidently in the digital economy. Built with suki-centered simplicity, it supports easy payments for:

- Online shops such as Shopee and Lazada

- Travel bookings and digital wallets

- Subscription services

- Secure money transfers powered by Visa Direct

Further, because PalawanPay is deeply rooted in the everyday needs of Filipinos, users can also receive remittances from abroad directly in the app. Sukis can also enjoy free cash-in at any of Palawan Express’ 3,500+ branches all over the Philippines — ensuring nationwide access to funds with zero extra cost.

Designed with zero intimidation and zero complications, it aligns with the real spending behaviors of today’s digital Pinoy.

Coming Soon: Physical PalawanPay Visa Card

By 2026, PalawanPay will launch its physical Visa card, providing even more flexibility for point-of-sale and in-store payments worldwide.